The Science of Saving: Why Saving Money Feels Disproportionately Good

There’s a certain kind of joy that comes from saving money. Not life-changing amounts—just little wins. Driving ten minutes out of your way to save five cents a litre at the gas station. Waiting in line for half an hour to get a free donut you weren’t even craving. Feeling oddly triumphant after getting $20 off a delivery order that you probably didn’t need in the first place.

Meanwhile, your investment account might go up or down $1,000 in a day and you go about your business.

Why does that happen? Why do small savings feel better than big financial shifts? Why does a free donut hit harder than a market rally?

The Science Behind Our Savings Obsession

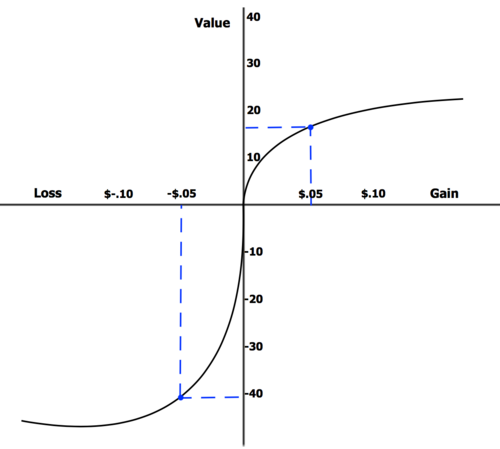

Behavioral economics has a few things to say here. Specifically, something called loss aversion. This was introduced by Daniel Kahneman (Nobel Prize winner and the writer of Thinking, Fast and Slow) and Amos Tversky, two celebrated psychologists focused on decision making and behavioural economics.

Loss aversion says losses hurt about twice as much as gains feel good. So, avoiding paying full price (even if it’s just a few bucks) feels more satisfying than making that same amount. It’s not about what we gain—it’s about what we avoid losing. There’s also the timing. Small savings are immediate. You see the price drop. You feel the win. Your brain gives you a little dopamine bump.

In one study, researchers found that people would drive 20 minutes to save $5 on a $15 purchase, but wouldn’t do the same to save $5 on a $125 item. The savings were the same. But the perceived value? Completely different.

How It Shows Up Day-to-Day

You’ve probably seen this play out:

- Spending 45 minutes comparison shopping online to save $10.

- Driving across town to use a coupon that expires today.

- Clicking “add to cart” just to hit the free shipping minimum.

In isolation, none of these are a big deal. But they add up, not just in money spent, but in time and energy too.

There’s nothing wrong with enjoying a discount. But sometimes it helps to pause and ask: Would I still buy this if it weren’t on sale? If the answer is no, maybe the savings aren’t really savings.

And then there’s time. Driving 30 minutes to save $5? Waiting in line for half an hour for a free coffee? At some point, it’s worth asking: Is this the best use of my time?

Because time is a resource too. And like money, once it’s spent, you don’t get it back.

The Takeaway

There's no need to fight against our behavioural inclinations. Small savings feel good. They’re tangible and immediate. But it's important to remember that they can also distract from the bigger picture. The goal isn’t to stop saving—it’s to spend (and save) with intention. To recognize when the pursuit of a deal makes sense—and when it’s costing more than it’s giving back.

One takeaway that I find helpful is to ask the question: Do I actually want the thing or do I just want the feeling that I got something for free? There's a lot to unpack here, but you'll notice how frequently it comes up in your day-to-day life. And it's not only physical goods: why do you think streaming services and software companies offer 30 day free trials?

Because, sometimes, the real cost of "free" is attention, energy, or most importantly, time.