Kakeibo - The Japanese Art of Mindful Money Management 💸

After spending the last two weeks immersed in Japan, I was pleasantly surprised by the ubiquity of fantastic $10 lunches, refreshing $4 draft beers, and perfect $1 onigiris. In a country known for its innovation and efficiency, the accessibility of such delightful experiences got me thinking: How do the Japanese approach money in a way that balances quality with affordability? It felt like the perfect time to delve into Kakeibo, the Japanese art of saving money.

Far from being just a budgeting method, Kakeibo embodies a philosophy that encourages mindful spending and purposeful living. Read on to explore how this century-old practice can transform our relationship with money by helping us find genuine value and intent in our financial decisions.

What is Kakeibo?

Kakeibo (家計簿) literally meaning "household financial ledger," was introduced in 1904 by Hani Motoko, Japan's first female journalist. Designed as a straightforward tool to manage household finances mindfully, Kakeibo emphasizes the importance of tracking expenses and reflecting on spending habits.

Far from being an antiquated relic, Kakeibo has experienced a renaissance in recent years, aligning with global movements toward minimalism and intentional living. Its philosophy resonates with those looking for a tactile, reflective approach to money management.

The Principles of Kakeibo

At its core, Kakeibo is less about accounting and more about cultivating mindfulness in financial decisions. It revolves around four fundamental questions:

- How much money do you have?

- How much would you like to save?

- How much are you spending?

- How can you improve?

By regularly addressing these questions, you develop a deeper understanding of your financial situation and identify areas for improvement. It's a practice that transforms budgeting from a chore into an act of intentional living.

How to Implement Kakeibo?

Step 1: Set Up Your Ledger

Begin with a notebook dedicated to your Kakeibo practice. Divide it into sections for income, savings goals, expenses, and reflections.

Step 2: Record Your Income and Fixed Expenses

At the start of each month, note your total income and subtract fixed costs like rent, utilities, and subscriptions. This gives you a clear picture of disposable income.

Step 3: Set a Savings Goal

Decide on a realistic amount you wish to save. This goal should be both achievable and motivating.

Step 4: Track Daily Expenses

Categorize your spending into essential and non-essential items.

- Essentials: Necessities such as groceries and transportation.

- Optional: Non-essentials like dining out or entertainment.

- Culture: Books, music, and activities that enrich your life.

- Unexpected: Unforeseen expenses like repairs or medical bills.

Step 5: Reflect on a Weekly and Monthly Basis

Regular reflection is the most important part of Kakeibo. At the end of each week and month, review your spending patterns:

- Did I meet my savings goal?

- Where did I overspend?

- Which expenditures brought genuine value?

- How can I adjust next month?

This process transforms Kakeibo from mere bookkeeping into a practice of intentional living.

Kakeibo in Contemporary Culture

Kakeibo's resurgence isn't limited to personal finance enthusiasts; it's part of a broader cultural shift toward mindfulness. Lifestyle publications and media outlets have highlighted Kakeibo as a counterbalance to modern life's digital saturation. Fumiko Chiba's book "Kakeibo: The Japanese Art of Saving Money," for example, became a bestseller upon its release in 2017, introducing the practice to a global audience.

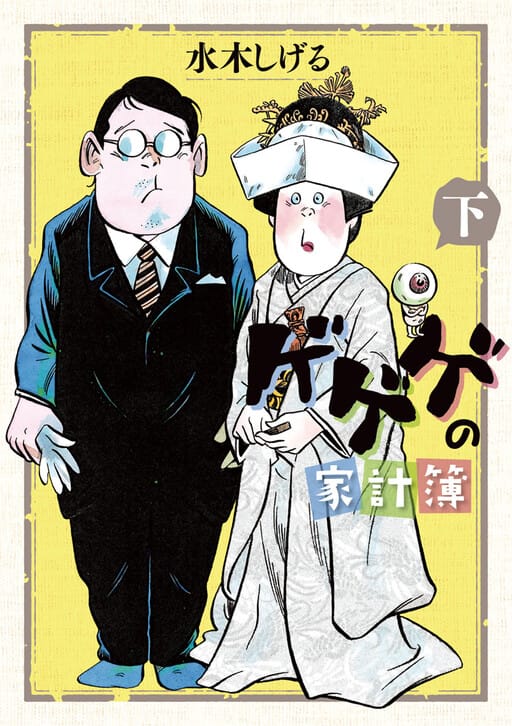

Within Japan, Kakeibo has made its way into popular culture, being featured in various mangas and movies that tackle personal finances. It plays a prominent role in the manga "Gegege no Kakeibo," underscoring its relevance in modern society and its appeal to younger generations seeking financial wisdom.

Mindful Savings & Spending

Kakeibo reminds us that it's important not only to be mindful of how we save but also how we spend. Thoughtful spending is something we take seriously at Nook: considering which expenditures bring genuine value to our lives.

This philosophy leads me to one of my favourite Japanese money-saving sayings:

Even with money-saving recipes I won’t compromise on good taste. 節約ご飯でも美味しさに妥協はしない

It's a beautiful reminder that frugality doesn't mean sacrificing quality or joy. It's about making conscious choices that enrich our lives while being mindful of our resources.