Asking Rents in Canada Have Decreased for the First Time Since 2020. Here's Why (and What It Means)

Has there ever been a better time to... rent? It's not the headline we were expecting in this housing market era of perpetual sticker shock, yet here we are.

According to the latest data, average asking rents for residential properties across Canada have dipped to a 17-month low. Let’s break down what’s happening, why rents are cooling off in some areas, and where things might go from here.

1) The Current State of the Canadian Rental Market

According to a new National Rent Report released by Rentals.ca, asking rents decreased by 3% in 2024 compared to the previous year. This marks the first annual drop since 2020, when rents fell 5.9% amid the pandemic-induced upheaval. For comparison, rents surged 8.6% in 2023 and an eye-watering 12.1% in 2022.

However, this trend isn’t uniform across the country. The lion’s share of the decline comes from Ontario, which saw a 5% annual dip in rent. Meanwhile, Atlantic Canada and Manitoba both bucked the trend with 5% annual increases.

| Province | Average 1 Bedroom Rent | % Change Y/Y |

|---|---|---|

| AB | $1,534 | 2% |

| Atl. Can | $1,811 | 5% |

| BC | $2,188 | -1% |

| MB | $1,412 | 6% |

| ON | $2,126 | -5% |

| QC | $1,690 | 1% |

| SK | $1,218 | 6% |

| CAN | $1,892 | -2.1% |

Source: Urbanation Inc., Rentals.ca Network data

When we zoom into cities, Toronto and Calgary saw some of the steepest annual rent decreases at over 7%. On the flip side, Quebec City became the country’s rental hotspot, with prices soaring 14.9% year-over-year.

In a surprising turn of events, the cost difference between a 1 bedroom rental in Toronto and Halifax has shrunk to a mere 14% ($2,360 vs. $2,030).

2) Why have rents been decreasing?

Rents in the Greater Toronto Area (GTA) and Vancouver have been steadily slipping for 17 months, thanks to a few key factors:

- Relocation to Lower-Cost Areas: The work-from-anywhere movement is alive and well, with many renters seeking refuge from sky-high rents by moving to more affordable regions.

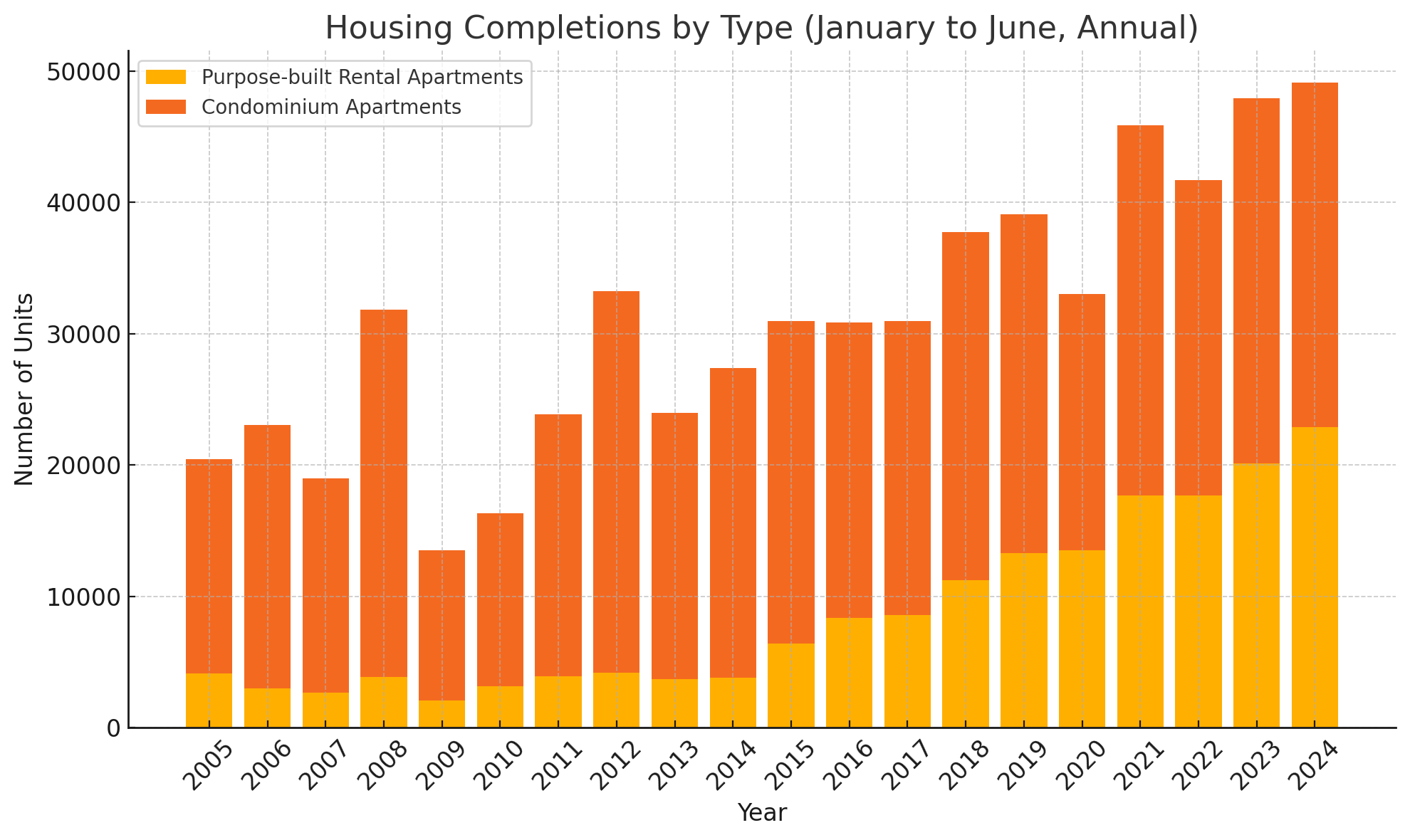

- A Wave of New Apartments: The number of newly completed rental projects has surged, especially in major urban centers. The combined level of rental construction across Vancouver, Calgary, Edmonton, Toronto, Ottawa, and Montreal in early 2024 was the highest since the 1990s (source: 2024 CMHC Fall Housing Report).

- Slower Population Growth: After a surge in 2022 and 2023, Canada’s population growth rate moderated in 2024, easing some of the demand pressure.

3) Where are things going? 🔮

In the short term, experts expect the rental market to continue its gradual softening. Slower population growth, coupled with a steady stream of new apartment completions, is likely to keep asking rents from bouncing back too quickly.

Of course, affordability is relative. Homeownership remains a distant dream for many Canadians, but the recent dip in rental prices offers a rare bit of breathing room for renters.

So, is this a long-term trend or a temporary reprieve? Only time—and maybe another CMHC report—will tell. For now, prospective renters can celebrate the fact that for the first time in a while, the rental market doesn’t feel quite as intimidating.