Do Falling Interest Rates Mean It's More Affordable for Canadians to Buy a Home?

Let's start with the good news. Interest rates have been falling, which, on the surface, lowers the cost of borrowing money.

The tricky part is to determine whether, over the medium term, lower interest rates will make it more affordable for Canadians to buy a home.

The Interest Rate Dilemma

Interest rates are like the mood lighting of the economy: change them, and the whole room can feel different. For the last few years, the Bank of Canada has kept rates relatively steady to curb inflation and discourage excessive borrowing. However, with inflation seemingly under control and economic growth showing signs of fatigue, economists predict that the Bank of Canada will cut interest rates for a third consecutive meeting on September 4th.

We've seen this play out before. In the early 2000s, a series of rate cuts following the dot-com bust and post-9/11 uncertainty fueled a housing boom. People were eager to buy, sellers were happy to sell, and prices soared. This worked out great—until it didn’t. When rates eventually rose again, some homeowners were in over their heads, leading to a familiar cycle of regret.

What a Rate Cut Could Mean Now

So, what happens if the Bank of Canada cuts rates? On the one hand, lower rates will make mortgages cheaper, easing the financial burden for homebuyers. That’s the optimistic view, at least. On the flip side, lower rates could drive more people into the market, increasing competition for homes and pushing prices up further—particularly in already-hot markets like Toronto and Vancouver, where the idea of affordability has long since become a distant memory.

However, not every housing market looks like Toronto’s. In cities where the market is cooler—think the Prairies or parts of the Atlantic provinces—a rate cut could help stimulate demand and boost local economies. A lower rate could make homeownership more accessible in these areas without the risk of pushing prices into the stratosphere.

Should Buyers Be Optimistic or Cautious?

Here’s where it gets tricky: should potential buyers be excited about a possible rate cut or approach cautiously? It’s a bit of both. A rate cut might lower your monthly payments, making it easier to get into the market. But there’s a catch: if demand spikes, the savings on interest could be offset by rising home prices.

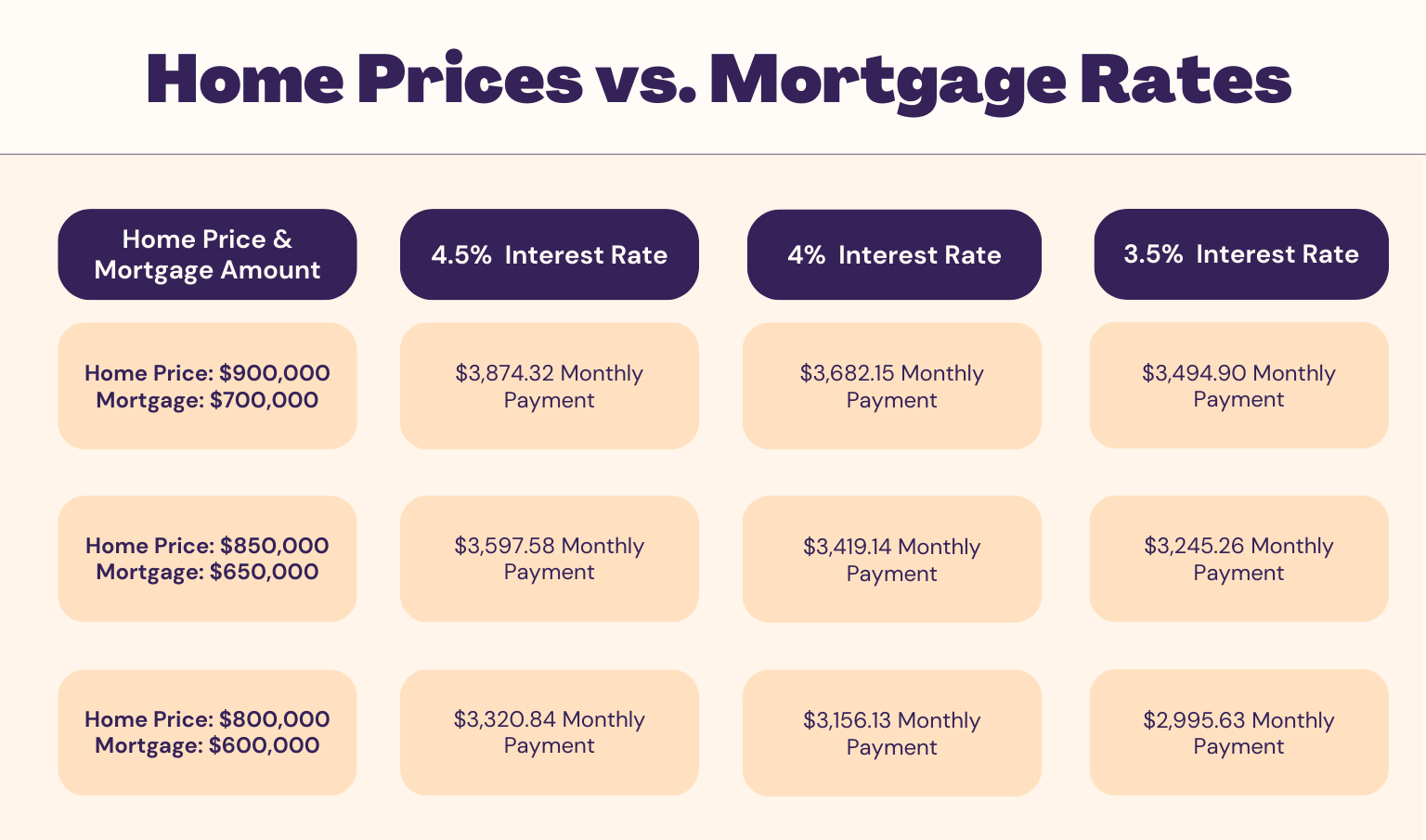

Take, for example, the three levels of mortgage rates and home prices below. We can see that a property with an interest rate of 3.5% still has a higher monthly payment than a property with a 4% interest rate, which is $50,000 less.

Moreover, a rate cut might signal underlying economic concerns. Lowering rates is often a tool to stimulate growth when there’s concern about a slowdown. So, while a lower mortgage rate sounds great, it might also come with less job security or slower wage growth— crucial factors when committing to a long-term investment like a home.

The Bigger Picture: A Cautious Optimism

Looking ahead, the outlook for the Canadian housing market remains mixed. Urban centers could continue to see price increases, particularly if borrowing becomes more affordable and demand stays strong. However, this isn’t a one-way street. Markets can shift, and economic conditions could change rapidly.

For would-be homebuyers, the key is to focus on what you can control. If you’re buying a home to live in for the long term, and are comfortable with the payments at today’s rates, a potential rate cut could be a bonus.

As the Bank of Canada weighs its options, potential buyers and sellers should be prepared for whatever comes next. A rate cut could make the dream of homeownership a bit more attainable, but it could also add new wrinkles to an already complex market. The best advice? Stay informed, consider your own financial situation carefully, and remember that in real estate—as in all things—timing is everything.