CMHC Mortgage Consumer Survey: State of Homebuying and Mortgages in 2025

A review of the recent 2025 CMHC Mortgage Consumer Survey and what it means for Canadians looking to buy their first home or renew their mortgage.

CMHC just released its 2025 Mortgage Consumer Survey, a close-up of how recent buyers, renewers, and refinancers feel about their home buying experience: working with a realtor and mortgage broker, shopping for rates, and ongoing maintenance costs.

This survey is a helpful pulse check on the state of homebuying for the upcoming year. It is especially useful if you are planning to buy your first home or renegotiate your mortgage and answers a simple question: how did your neighbours feel when they had to make the same decisions you are making today?

There is one hitch: timing. The survey was conducted in the before times, back when tariffs weren't a thing and the economic picture was still rosy.

So with that context in mind, let's review the results of the survey, how things have changed since then, and what this all might mean going forward.

A note on timing

It's worth spending a moment on the timing of the survey. CMHC interviewed almost 4,000 Canadians between January 2 and January 24, 2025. Everyone polled had completed a mortgage deal in the preceding 18 months, most of them buying or renewing from late 2023 through 2024. The survey captures their January feelings about deals struck during that window.

So although it is recent-ish, it fails to capture what has unfolded since then. And as we know, a lot has happened since January:

- U.S. tariffs. Washington's on-again, off-again, TACO tariffs 🌮. Just this week steel and aluminium tariffs doubled to 50%. Overwhelmingly, there remains uncertainty as to what may come next.

- A cautious central bank. After trimming its policy rate to 2.75% in March after 7 straight rate declines, the Bank of Canada has held the rate steady since then, explicitly citing trade uncertainty.

- Softer economic forecasts. Economists are now calling for a mild contraction in the second half of the year, pointing to the tariff overhang and high debt service costs.

Those developments frame everything that follows, and I think provide helpful context when reading through the survey that the ground underneath us all has shifted quite a bit over the preceding 5 months.

What the survey tells us about recent borrowers

Optimism recovered. 74% of respondents expected their home value to rise over the next twelve months, up from 65% a year earlier. Roughly the same share felt comfortable with their current mortgage debt.

Renewals ruled the day. Renewals accounted for 65% of all mortgage transactions, continuing a three-year climb from 58% in 2023.

First-time buyers. First-time buyer activity edged up (12%) but still sat far below the levels seen during the pandemic boom. Interestingly, 54% of first-time buyers purchased their home with someone other than their partner or spouse.

Family help kept flowing. A growing slice of buyers leaned on gifts or inheritances for their down payment. The average gift was $79,127. With respect to first-time homebuyers, 41% used funds from a gift or inheritance to assist with the purchase.

Secondary suites to help. About one quarter of owners already rent out part of their home, and another 10% intend to add a suite. Rental income is increasingly seen as the buffer that lets households handle higher payments.

Mortgage research went social. More than half of respondents said they turned to platforms like YouTube or Instagram for mortgage advice, a sharp jump from the year before. Traditional broker websites still matter, but the first search often happens on a phone, not a lender portal.

Taken together, the portrait is of borrowers who still believe in real estate wealth but hedge their bets with rental income, family equity, and constant rate shopping on social media.

You can read the full 2025 Mortgage Consumer Survey here. CMHC also put out a video summarizing the results:

How the ground has shifted since January

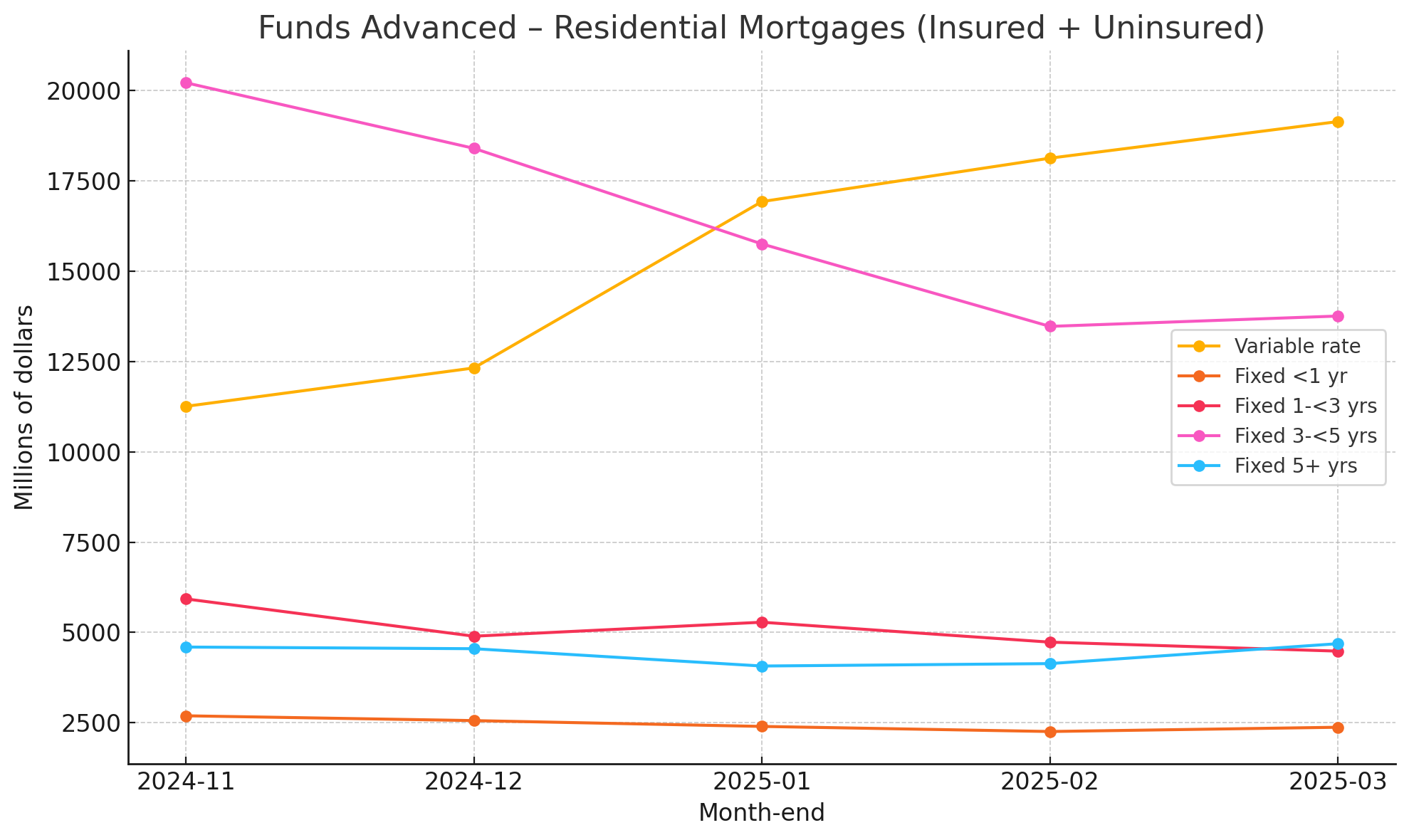

Variable rates are back. Bank of Canada data shows that more homeowners are moving to variable rate mortgages. In November last year, variable rate mortgages represented only 25% of total new mortgage volume, whereas that number climbed to 43% in March 2025.

Rates are lower but the payment shock remains. Five-year fixed offers have dropped 35–50 basis points, but many 2020–21 borrowers still face renewals two to three points higher than their current rate.

Caution replaces optimism. Forecasts for a shallow recession have replaced talk of a soft landing. If job growth falters, payment difficulty could climb regardless of where bond yields settle.

What this means for buyers and renewers

- Run a tougher stress test. Base your budget on a rate about 1.5 points above today’s available fixed offers. Policy cuts can pause if trade frictions flare.

- Negotiate on price as much as on rate. Sellers are showing more flexibility than lenders. A $20,000 discount on the purchase price is often easier to achieve than a small rate concession.

- Keep an eye on tariffs. Even with the Bank of Canada holding its policy rate at 2.75% this week, further trade actions could push borrowing costs slightly lower. While it's unlikely that much will occur over the summer months, come Labour Day, we could see mortgage rates start to decrease again.

Conclusion

The 2025 survey captures a moment of tentative confidence. Since January, tariffs, cautious policy, and softer forecasts have nudged the market onto shakier ground. If you are buying, don't bet on rates lowering in the near term and base your plan on solid fundamentals: income stability, a realistic stress test, and a clear view of total housing costs. If you are renewing, start early, gather competing offers, and remember that shaving a few basis points matters less than keeping your overall budget resilient. In this market, those who are prepared and start early will be rewarded.

If you'd like to read more on these topics, a good companion piece is our guide to buying a home in 2025: