Canada's mortgage renewal wave is coming. How to prepare if this includes your home.

"I took off on a wave, went down the side, popped out the other end, and went, shit, I'm still alive!" - Greg Noll

Over 4 million Canadian homeowners are approaching a big moment: mortgage renewals in 2025 and 2026. Rates have cooled a bit recently, but they’re still considerably higher than what most people locked in at five years ago. This makes the upcoming renewal a critical financial decision.

Below, we break down what’s happening, what to expect, and how you can prepare. We also provide some tips to ensure you're getting the best rate and reducing your financial exposure.

1. The Big Picture: Mortgages by the Numbers

As of 2024, Canada has about 6.9 million active mortgages. Over the next two years, 60% of these will come up for renewal. This unprecedented renewal wave largely stems from the pandemic housing boom, when many Canadians locked in 5-year fixed-rate mortgages at historically low rates.

On December 11th, the Bank of Canada lowered the policy rate to 3.25%. While that's a positive step for those renewing in 2025, it's still much higher than the record low rates of 2020 and 2021. As a result, homeowners can expect an average monthly payment increase of $513 when their mortgage renews in 2025.

2. 2024 Mortgage Trends: Short-Term Thinking or Strategic Gambles?

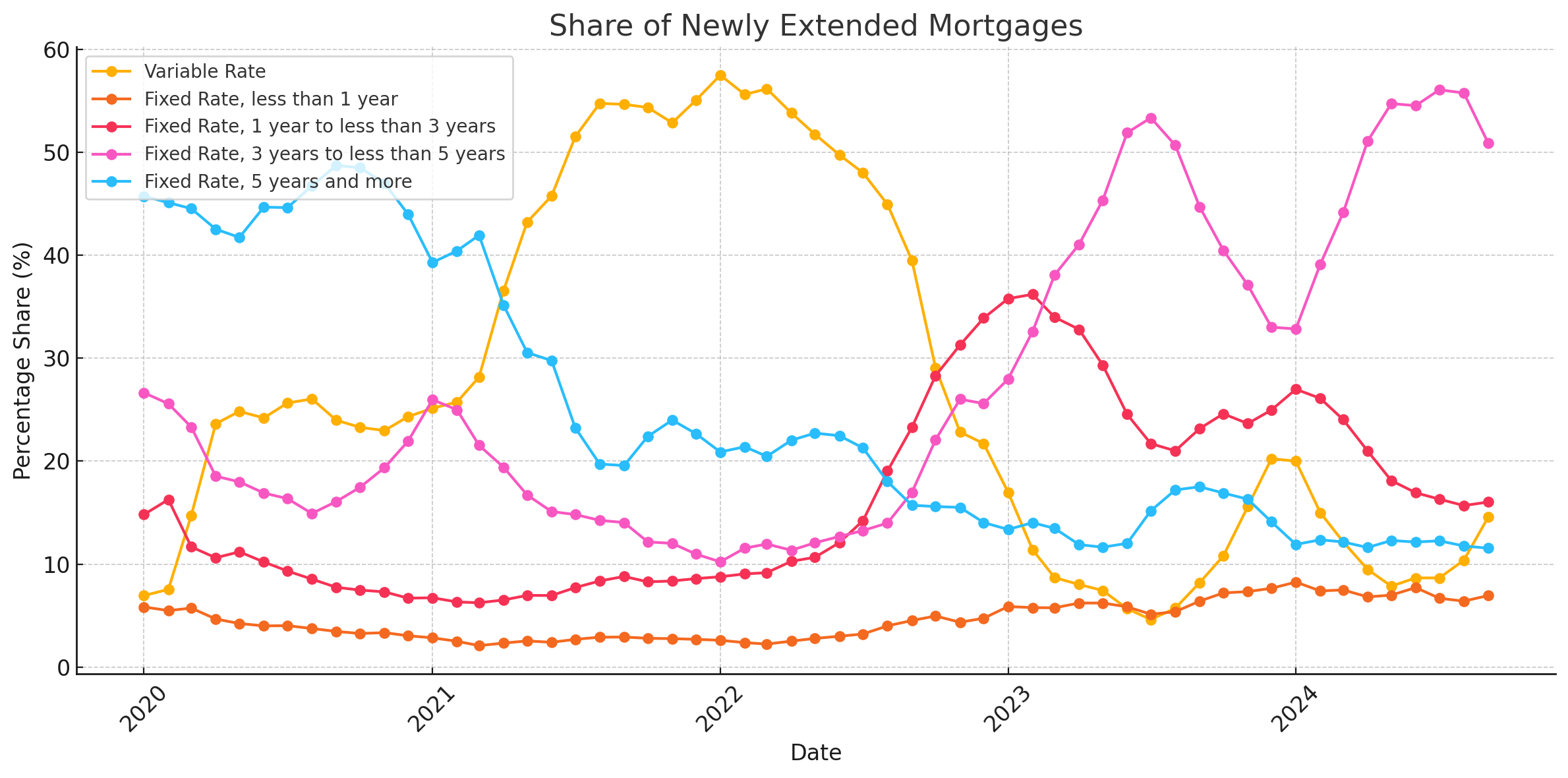

Homebuyers in 2024 have leaned toward short-term fixed-rate and variable-rate mortgages, hoping for further future rate cuts. This approach prioritizes flexibility but comes with more risk if rates stay higher for longer.

In contrast, the popularity of long-term fixed rates has waned, as borrowers hesitate to lock in at current highs.

Below, you can see that 5 year fixed-rate mortgages as a share of total mortgage volume is the lowest it's been in the last 5 years.

3. Renewing Soon? Keep These 5 Tips in Mind

- Avoid the “Loyalty Penalty”: Around 45% of Canadians simply renew their mortgage with their current lender without shopping around, while only 8% said they significantly negotiated the rate. The result is homeowners are left with a higher interest rate and much higher monthly mortgage payments.

- Shop Around Early: Begin exploring your renewal options six months before your mortgage expires. This gives you time to compare lenders, negotiate, and weigh alternatives. Don’t assume your lender’s first renewal offer is competitive, as it rarely is. With lenders vying for your business, you have leverage.

- Assess Your Budget: With rates significantly higher than five years ago, it’s important to prepare for higher monthly payments. Start adjusting your spending habits now to soften the impact later. This is especially important for older Canadians nearing retirement that may be living on a fixed income. Rising mortgage payments could force difficult decisions, such as downsizing earlier than planned.

- Negotiate More Than Just Rates: While interest rates grab headlines, don’t forget about other mortgage terms. You can negotiate prepayment privileges, amortization periods, and even penalties for breaking the mortgage early. These can significantly affect your long-term costs.

- Get Professional Advice: A mortgage broker or financial advisor can help you navigate this complex market. They have access to multiple lenders and can negotiate on your behalf. They’ll compare lenders, advocate for better terms, and help you strategize.

4. The Economic Ripple Effects of a Renewal Boom

Over 4 million mortgages renewing in a high-rate interest environment will have ripple effects beyond individual households. Increased monthly payments might curb consumer spending, which could slow down economic growth. At the same time, an uptick in mortgage delinquencies could add stress to Canada’s financial system.

Final Thoughts: Preparing for the Wave

The upcoming wave of mortgage renewals will be an important financial event for individual households, with broader effects on the economy. The good news? If you stay informed, get ahead of it, and explore your options, you’ll be in a better position to soften the blow of higher interest rates and secure a mortgage that you and your family can afford.

"You can’t stop the waves, but you can learn to surf." - John Kabat-Zinn