A Field Guide to Buying a Home in Canada, mid-2025

It’s May 2025, the Bank of Canada’s policy rate sits at 2.75% after seven quarter‑point cuts, and, despite this cheaper money, the national average resale price is still $678,331. This is down 3.7% from a year ago, but it still puts the majority of Canadians, and especially young Canadians, outside of the housing market.

So is this finally a buyer’s market? Not exactly. Think of the 2025 housing landscape as a mosaic of micro‑markets: many markets have cooled off, while others are still staying relatively warm. Below we've provided a region‑by‑region report, a sanity check on where prices may drift next, and a no‑nonsense playbook if you're looking at getting the keys to a new house over the next year.

1. A Quick National Weather Report

- Money is cheaper but still not free. The lowest insured five‑year fixed quotes run around 3.79%; variable rates hover just under 4%.

- Prices are flat‑to‑soft nationally. CREA now pegs 2025 for a ‑0.3 % year‑over‑year dip, with B.C. and Ontario doing most of the pulling down.

- Inventory is climbing, but unevenly. Months of supply sit at 5.1 nationwide, which, on paper, seems balanced. But there are outliers, like Toronto's condo market, where unsold inventory equals to 78 months of supply based on the pace of sales over the last 12 months.

2. Regional Snapshots

| Region | 2025 Mood | What’s Worth Watching |

|---|---|---|

|

West Coast (Greater Vancouver & Victoria) |

Prices have slipped 2‑4 % YoY; detached listings remain scarce, but condo inventory finally gives buyers elbow‑room. |

Seller discounts on units that face alleys. Balanced market means buyers can insist on inspection clauses. |

|

Prairies (Calgary, Edmonton, Saskatoon) |

In‑migration and wage growth keep demand relatively firm; Calgary’s detached benchmark hit $769,800 in March, up 4 % YoY. |

Detached under $750k still see multiple offers. New‑build pipeline is still overly large, so it's easier for buyers to avoid the new-build premium. |

|

GTA & Southern Ontario |

Tale of two assets: low‑rise holds value, but 23,918 new condos sit unsold—78 months of supply, a 30‑year record. |

Developers are bending on closing costs and upgrades. End‑user units with family‑sized floor plans (<1 000 sq ft) hold resale value. |

|

Quebec & Atlantic Canada |

Price growth is modest but positive almost everywhere; St. John’s posted a record $352,370 average, up 18%. |

Small‑town multis still cash‑flow at today’s rates; demand from inter‑provincial migrants remains sticky. |

3. Where Prices Could Drift Next

Economists are splitting hairs: Reuters’ poll has prices lagging inflation, up maybe 2%; CREA pencils in essentially flat; RBC thinks Prairies, Quebec, and Atlantic Canada will outpace the rest.

Rate cuts usually need six‑plus months to filter into bids, so the real test arrives this autumn. If tariffs deepen or immigration slows further (the federal plan has trimmed permanent‑resident targets to 395 k in 2025) expect only a light tail‑wind for prices.

4. What Counts as a “Good Buy” in 2025?

- Deep‑inventory urban condos (downtown Toronto, Surrey Central, Ottawa’s west end). When supply tops six months, sellers negotiate more than list prices—think parking spaces thrown in, capped assignment fees.

- Starter homes in migration magnets (Calgary outskirts, Saskatoon east side, Halifax suburbs). Wage gains in these areas are outrunning mortgage costs, leading to areas where prices are still lower than the rest of Canada, but the market hasn't softened here like other urban centres.

Caution flags? Pre‑construction condos in the GTA (carrying costs rise into 2026) and recreational cottages that doubled in 2021 but now draw crickets at showings.

5. Who’s Actually Buying?

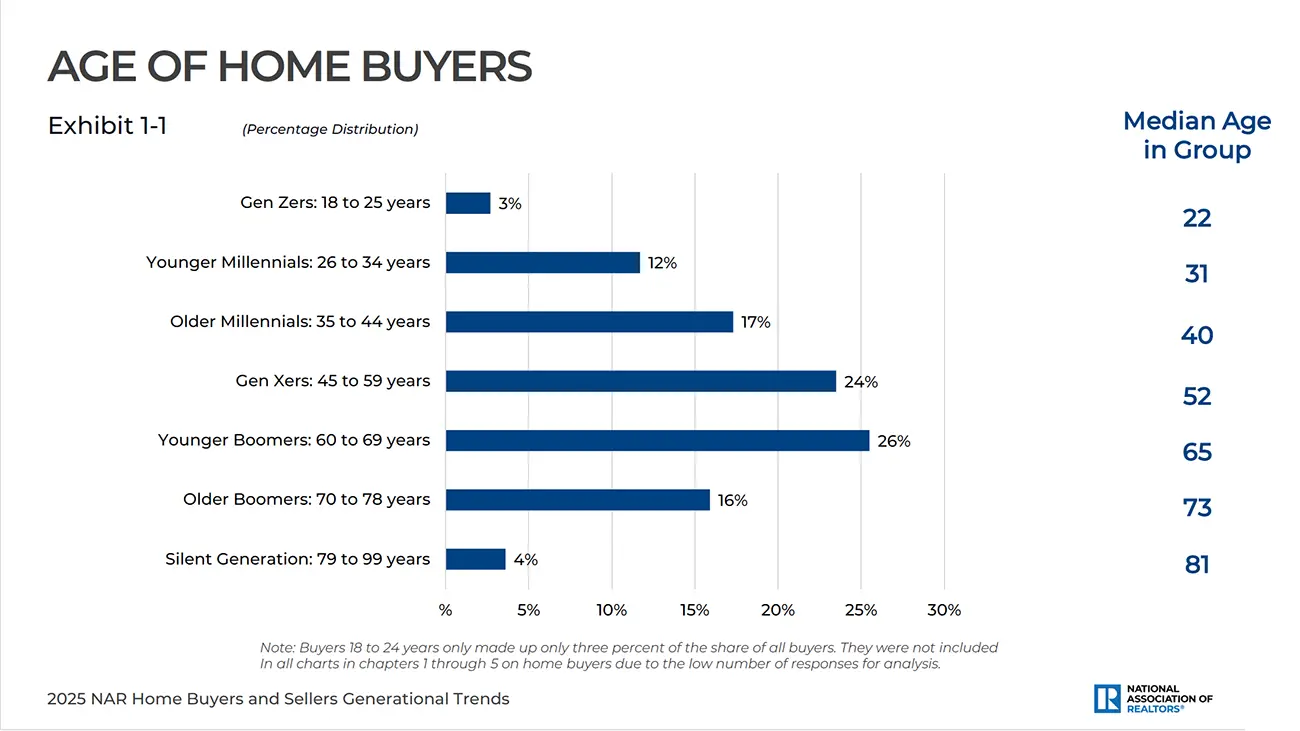

- Millennials remain the engine. They account for roughly 29 % of recent buyers—the largest of any cohort.

- Intent is high even among Gen Z. A NerdWallet poll shows 12 % of Canadians plan to buy within 12 months, and 74 % of those aged 18‑34 say they’ll buy within five years.

- Investors are on the sidelines. Vacancy taxes in B.C. and Ontario plus softer rents have pushed many to “wait and see,” especially on GTA condos.

6. The 2025 Canadian Home‑Buyer Playbook

- Budget at the stress‑test rate, not the headline rate. Lenders still add two points to your contract rate, so a 3.8 % mortgage must qualify at 5.8 %.

- Collect multiple mortgage pre‑approvals. Big banks, credit unions, and an online mortgage brokers—120‑day mortgage rate holds cost nothing and only benefit the buyer.

- Pick your micro‑market. Remote‑flex job? Compare Calgary’s detached homes against a GTA townhouse—price gaps remain wide.

- Read every condo document. Reserve‑fund studies older than three years are red flags; look for parking‑garage or façade projects lurking in the condo minutes.

- Write offers with conditions again. Balanced markets let you keep financing and inspection clauses without being laughed out of the room. And after the inspection is done, buyers can now add clauses to the purchase and sale agreement to fix deficiencies before closing.

- Budget 2‑5% for closing costs. Land‑transfer tax (double in Toronto), lawyer fees, PST on CMHC insurance if your down payment is <20 %, plus the first Home Hardware run that always costs more than you think.

- Future‑proof your renewal. A three‑year fixed at 3.6 % feels great; just model a 4 %‑plus renewal in 2028 so you aren't shocked in the future.

The Bottom Line

2025 isn’t the frenzy of 2021, nor the stickershock of 2023. It’s a market handing buyers the rare gift of time: time to inspect, to negotiate, to ask for deficiencies to be cured. The best buys this year aren’t necessarily the cheapest; they’re the homes whose stories still make sense after a home inspection or a careful review of the condo documents.

House‑hunting remains emotional, but the data says you can be rational, successful, and take your time in 2025.

Happy hunting.